Ripple Effect

The Ripple Effect

The direct impact of poor work practices on the bottom line is obvious when you look at claim outcome performance. If you knew where you were going wrong, you’d improve your practice to control those costs.

The bottom line…Insurers need to satisfy both customers and investors

- Reduce operating costs

By streamlining processes & using a portfolio design enabling you to align the most cost-effective resources to each segment. - Improve health and financial outcomes

By actively facilitating maximum recovery and preventing re-opens while keeping claim costs sustainable. - Create advantage

By being able to prove and demonstrate your ‘best practice’ with cause &-effect measurement that generates in-house knowledge and attracts expertise (both service partners and employees).

Financial Impact

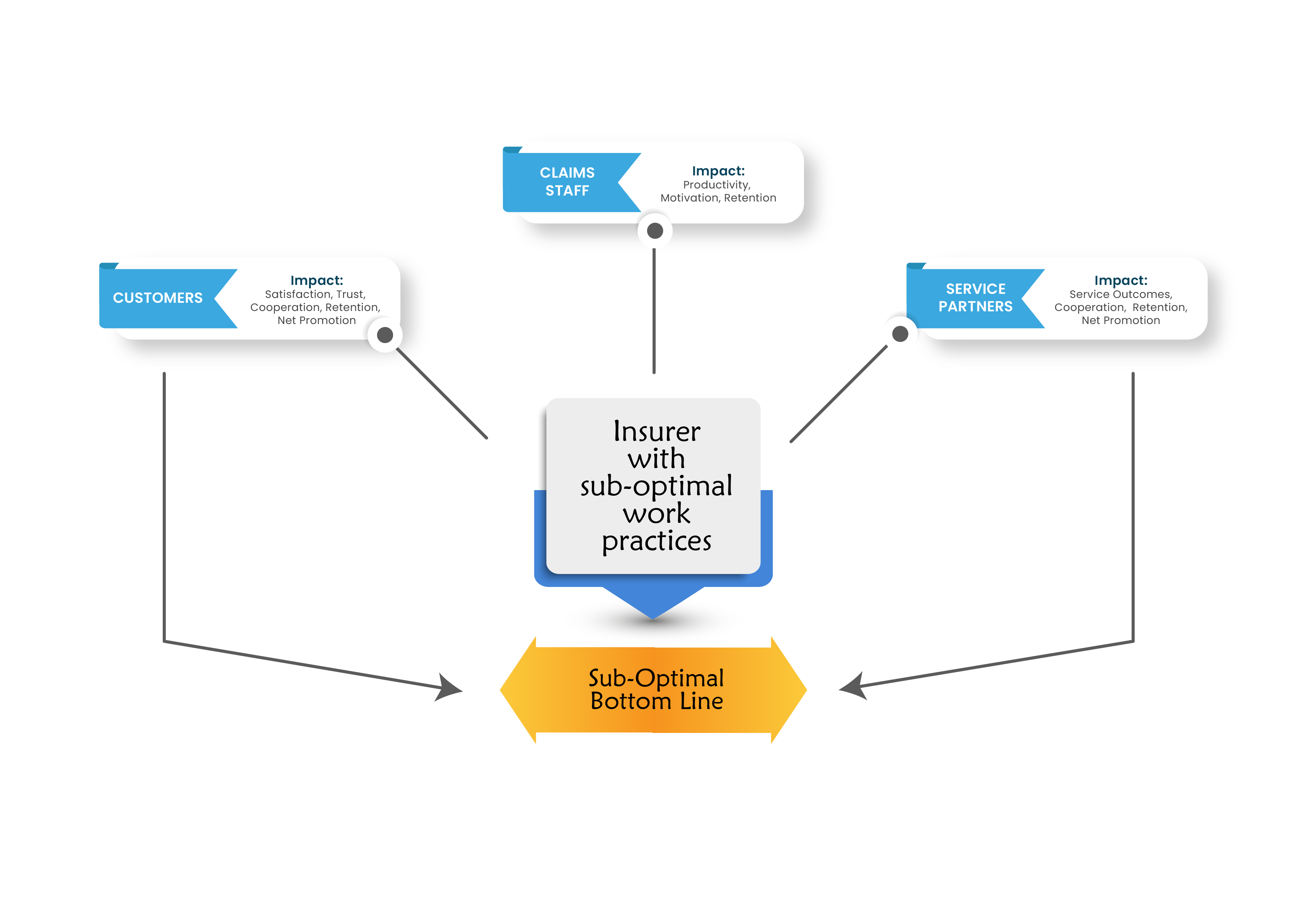

The financial impact of suboptimal work practices is not limited to the direct costs of claim outcome performance.

The ripple effect is extensive:

- Reduced premium from poor customer satisfaction and retention

- High operating costs associated with process inefficiencies

- Low staff productivity and retention

- Higher marketing costs from inconsistent performance

- Limited growth from a lack of meaningful innovation